28+ i missed a mortgage payment

Mortgage forbearance during COVID-19. Web The first time you make a payment over 30 days late on a mortgage your credit score sometimes called a FICO score could drop 50 to 100 points.

How Many Mortgage Payments Can I Miss Bankrate

If you know that you are going to be missing a payment or two in the upcoming months you can use this Skip a Payment feature.

. But the use of these payment. Save Real Money Today. Save Time Money.

Web 15 hours agoBorrowers with an average 600000 mortgage have seen their monthly mortgage repayments surge by 375 per cent to 3683 from 2678 since May last year. Web Suppose your servicer offers you one year to make up the 3000 that was unpaid due to the forbearance. Web Point drop.

Because your late payments happened in the past year you may find that lenders offer you higher mortgage interest rates which will in turn increase your monthly payments. If carefully budgeted for it can make sense as it has for me. If You Need Time We Can Help.

Web 4 hours agoYes buy now pay later can help you spread the cost of an important purchase for no extra cost. Web Initially late mortgage payment consequences will start with a penalty fee and if the payment is more than 30 days overdue it could be reported to credit bureaus. Borrowers missing a loan repayment during.

Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Ad See how much house you can afford. Estimate your monthly mortgage payment.

Late rent payments for their part do not show up. You will be given 30 days to make up all outstanding payments. Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders.

60-80 on your first late payment. Find A Lender That Offers Great Service. So your total mortgage payment would be 1250 until you make up the skipped payments.

Web Most financial institutions have a Skip a Payment option included within their mortgage. After a second mortgage payment is missed the mortgage servicer will send a letter to you. And a foreclosure can sink your credit score by a whopping 150 points Espinoza says.

Falling behind once makes it difficult to get back on track. Web If you miss a mortgage payment entirely and do not pay invoices during the grace period it can lead to further action. Web Your payment history is the most important factor in your credit scores and recent payment history has the most impact.

Its easy to fall into a habit of making late mortgage payments because mortgage payments are most peoples largest monthly expense. Web If missing your payments becomes more than a one-off situation and youve tapped into all your other options including a line of credit and tax-free savings account you could end up in a. Web If you miss one mortgage payment youll likely be contacted by your lender but its unlikely your home will be foreclosed right away.

After The First Missed Mortgage Payment Following your first missed mortgage payment your loan provider will typically report the missed payment to credit bureaus after it is 30 days late. Get Instantly Matched With Your Ideal Home Financing Lender. Doing the math that comes to 250 added to your regular mortgage payment each month for one year.

Web If you miss several mortgage payments you will be in default under the terms of the mortgage. Our Foreclosure Advocates Can Help. Ad Summit Is The Leader In Foreclosure Alternatives.

You may receive a formal letter alerting you to the. 455 5 votes If you miss a second mortgage payment youre likely to see a change in the mortgage servicer. Compare More Than Just Rates.

You will receive a letter from the mortgage lender stating you have 30 more days to bring your account up to date. Ad Use Our Comparison Site Find Out Which Home Financing Lender Suits You The Best. Ad Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Web Usually if you miss one or more payments on your mortgage loan your loan is considered to be in default but you might have special rights related to the COVID-19 pandemic. Web Generally failure to pay your mortgage will be reported by your lender to the major credit bureaus and they will lower your credit score. Its usually available through your online banking account.

What to know and what to do and CARES Act. The effect missed mortgage payments can have on a credit score is significant since payment history makes up 35 of a credit score. After your grace period this is usually one week to fifteen days after the payment due date a late fee will be added onto the payment you failed to make.

Taking out a mortgage and paying it on time is one of the most effective ways to boost your credit score but a missed payment can result in a quick drop. If you want to stay in your home you need to speak to the lender to avoid foreclosure proceedings. The letter will tell you that they are in default.

To learn more read these resources from the Consumer Financial Protection Bureau. Learn How We Stop Foreclosures.

What Happens If You Miss A Mortgage Payment

When Is A Mortgage Payment Considered Late Insurance Noon

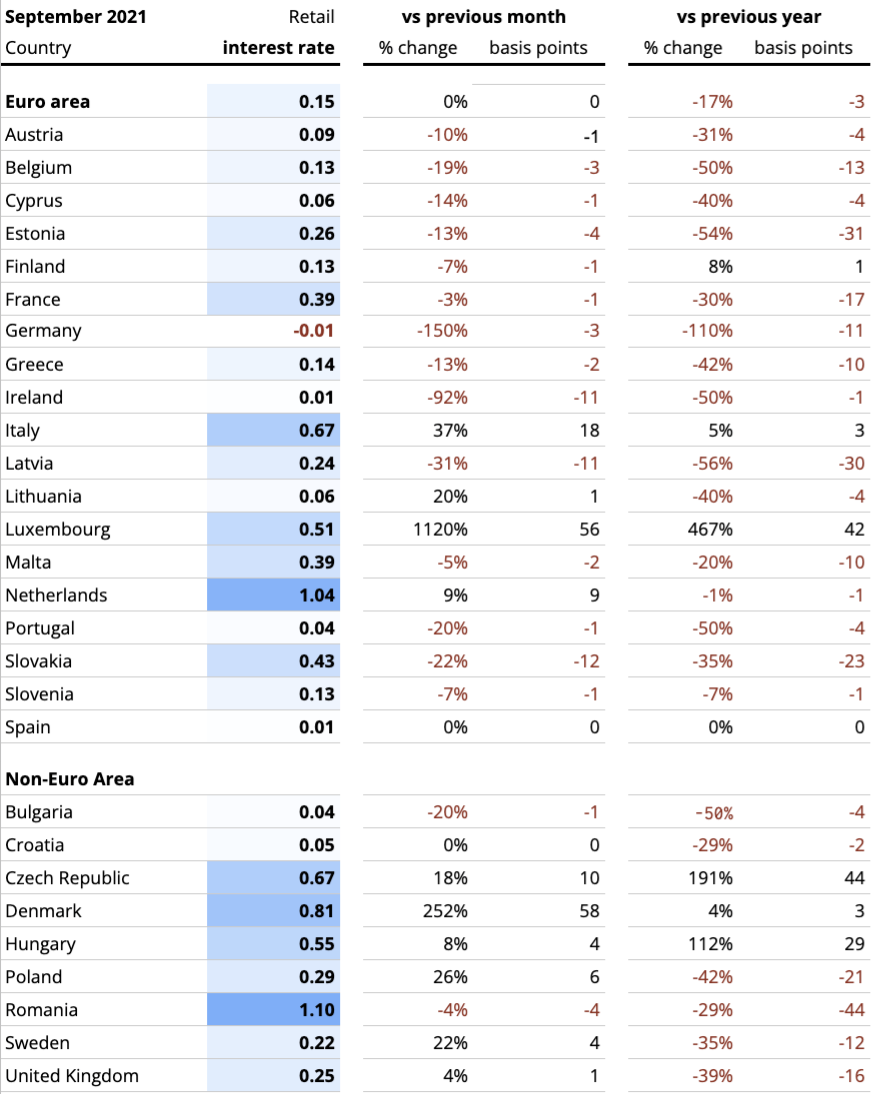

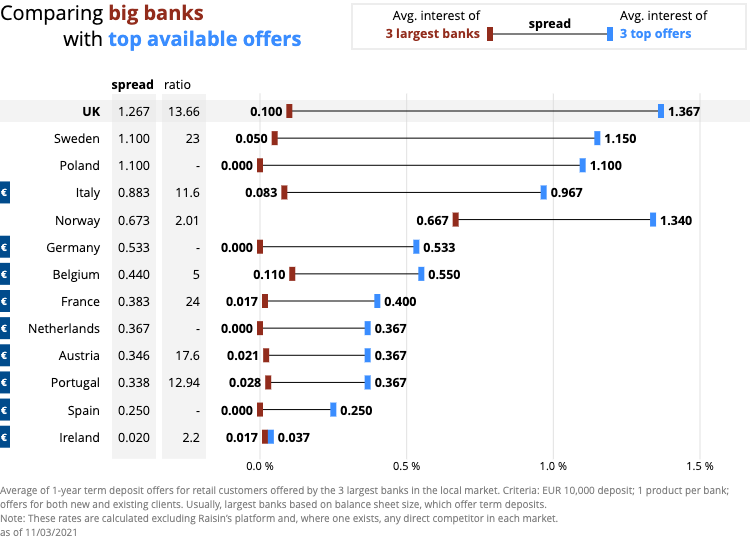

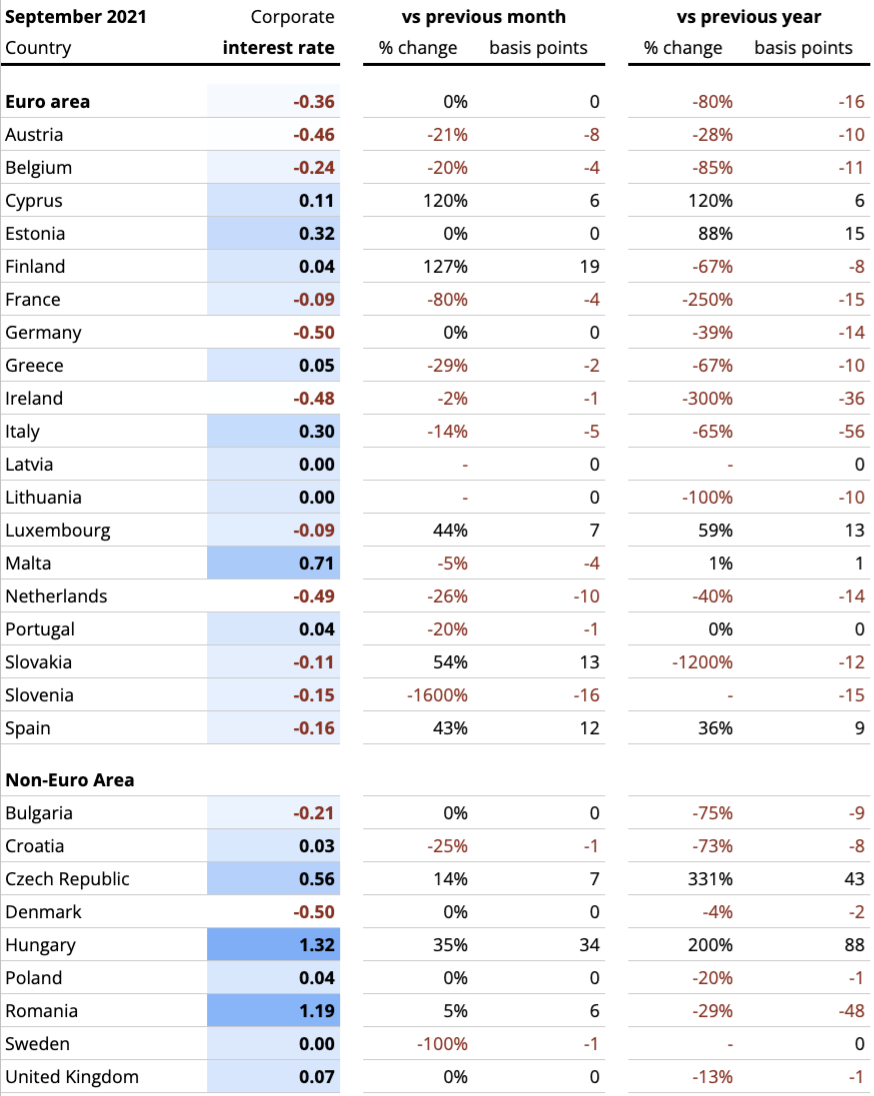

Raisin S Interest Rate Tracker

Missed Mortgage Payments Haysto

What Happens If I Skip A Single Mortgage Payment The Motley Fool

Interest Rates Explained By Raisin

A Breakdown Of The Monthly Mortgage Payment What To Expect

5 Alternative Ways To Use A Mortgage Calculator Zillow

How To Pay Off A 30 Year Mortgage In 15 Years Debt Org

Raisin S Interest Rate Tracker

Buy Break Free From Your Mortgage The Secret Banking Strategy To Help Youy Pay Off Your Mortgage Fast Book Online At Low Prices In India Break Free From Your Mortgage The

![]()

What Happens If You Miss A Mortgage Payment The Motley Fool

What You Need To Know About Late Mortgage Payments Lendingtree

I Ve Missed My Mortgage Payment What Are My Options

What Happens If You Miss A Mortgage Payment Getjerry Com

Missed Mortgage Payments Haysto

Repost From Fb Idk How People Have The Gall To Write This Shit Up R Lostgeneration